Are you an investor who wants your money always working for you?

With a Securities-Backed Line of Credit (SBLOC), you can keep your investments fully invested while borrowing against your managed accounts—giving you liquidity without disrupting your strategy.

Brought to you by Charles Schwab and Karstens Wealth

What Is a Securities-Backed Line of Credit?

A securities-backed line of credit allows you to pledge eligible investments as collateral in exchange for a revolving credit line. This gives you fast access to cash while keeping your assets in the market and potentially growing.

Simple Process

Set up Investment Managed Account. Quick and simple underwriting process.

5 to 10 Day Turn Around

Get Investment Account Set up with Charles Schwab, Apply for loan, simple documentation.

Expert Advice

Get advice from experienced team with your best interests in mind. Excellent Investment Advisor Advice and Managed Accounts

Loan Amounts As High As 95%

Very High Loan Amounts with Fully Diversified Investment Portfolios

*Offering through Karstens Financial and Karstens Wealth. Lending through Charles Schwab

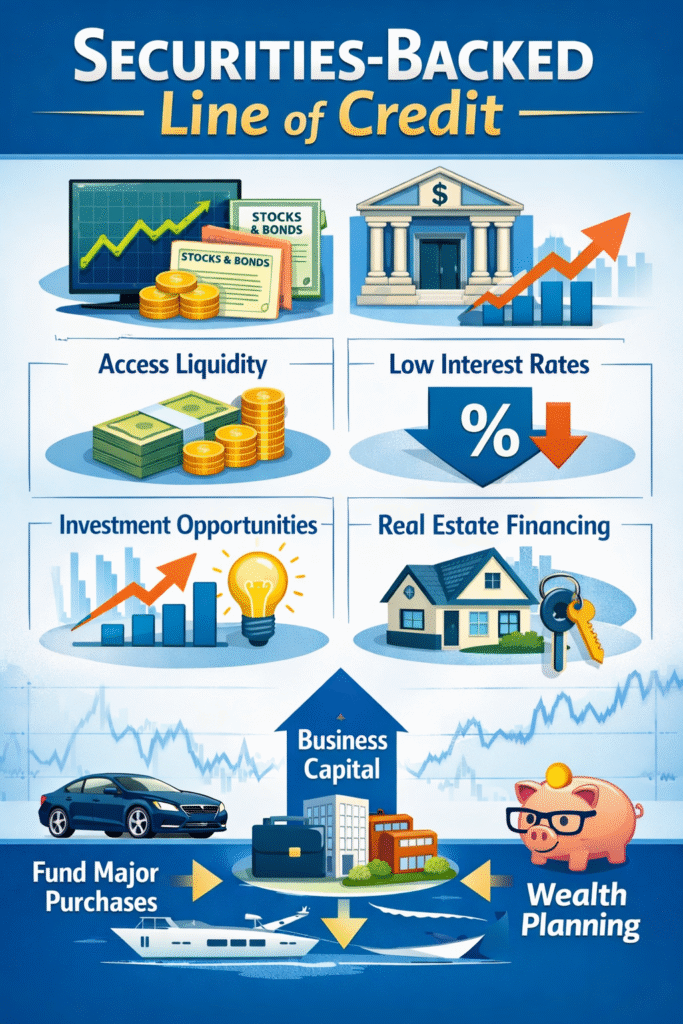

Why Investors Use Asset-Based Lending

Extremely Competitive Rates

LIBOR-based variable options + fixed-rate options available.

Fast Turnaround

Loan documents delivered within 5 business days.

Keep Your Investments Working

Access liquidity without selling your securities.

Flexible Collateral Options

Borrow as an individual, business, or trust.

Use multiple portfolios as collateral if needed.

Smooth ACAT Transfers

Use financing to pay off existing loans and transfer accounts seamlessly.