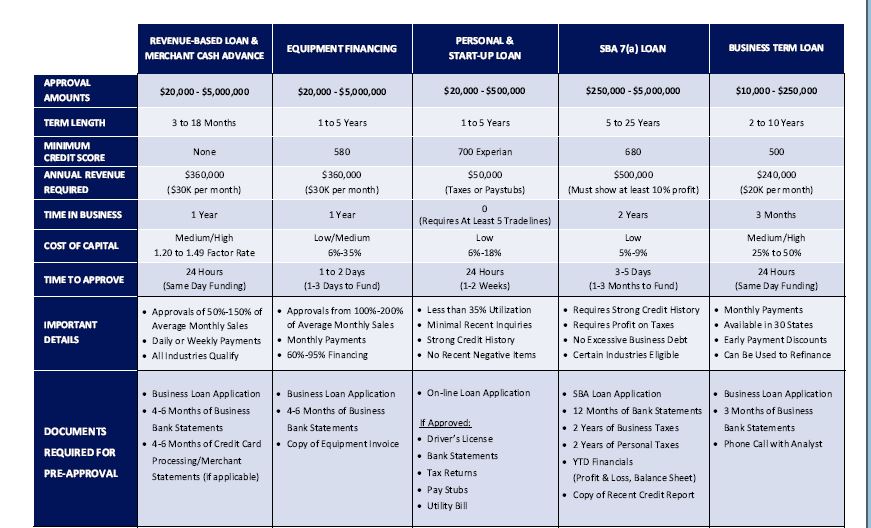

CHOOSE THE LOAN PROGRAM THAT WORKS FOR YOU

Business Loans

Karstens Financial offers a wide variety of business loan programs for all types of industries. We understand that easy access to capital is vital for day-to-day operations & for expansion. Whether you’re looking to purchase equipment, invest in marketing, or take on new projects, Karstens Financial makes the business lending process fast & simple.

Business Cash Advance

If you need quick access working capital & generate at least $20,000 in monthly revenue via credit card processing transactions, a Karstens Financial merchant cash advance may be the best option for you. It adjusts itself to the performance of your business (pay a small % of daily card sales) & it doesn’t require you to switch your processing company.

Business Line of Credit

Having access to working capital when you need is important when running a business. Karstens Financial offers revolving business line of credit. Once you have a pre-approved limit, you can access funds at any time and only pay interest on the line of credit used. Benefit from monthly payments, a quick application process, and building business credit history.

Revenue-Based Business Loan

Do you need funds within 24 hours with minimal paperwork? As long as your business has a minimum of 12 months of operation & generates a minimum average of $20K in bank deposits, you can be approved for up to 150% of your average monthly revenue. No minimum credit score required. Available in all 50 states, Canada, & Puerto Rico.

SBA Business Loan

SBA (Small Business Administration) loans have low rates, long terms, & are secured by the US Government. As a result, the application process can be difficult. It requires significant paperwork, 2-3 months of review, & has strict qualification criteria (700+ credit, high profit, 2+ years of operation, etc.). Do you qualify? Apply today!

Equipment Financing Loan

Obtaining the right equipment can increase revenues & contribute to the growth of your business. Karstens Financial equipment leasing & financing programs allow you to conserve cash flow (low monthly payments), benefit from tax savings, and build business credit. Let our quick approval process help you finance the equipment & machinery you need.

Unsecured Term Loan

A Karstens Financial business term loan is a simple interest loan with monthly payments, low rates, & terms up to 5 years. It is ideal for established businesses that may qualify for a bank loan, but seek a quicker & easier funding process. No collateral is needed, and payments start a month after funding.

Startup Business Loans

Have you always wanted to start a business but lacked capital? A startup business loan with Karstens Financial can help turn your dreams into reality. If you have a strong credit history (680+) and can demonstrate annual income of at least $30K a year, you may qualify for this startup loan program based on personal credit.