Anchoring your future.

Anchoring your future.

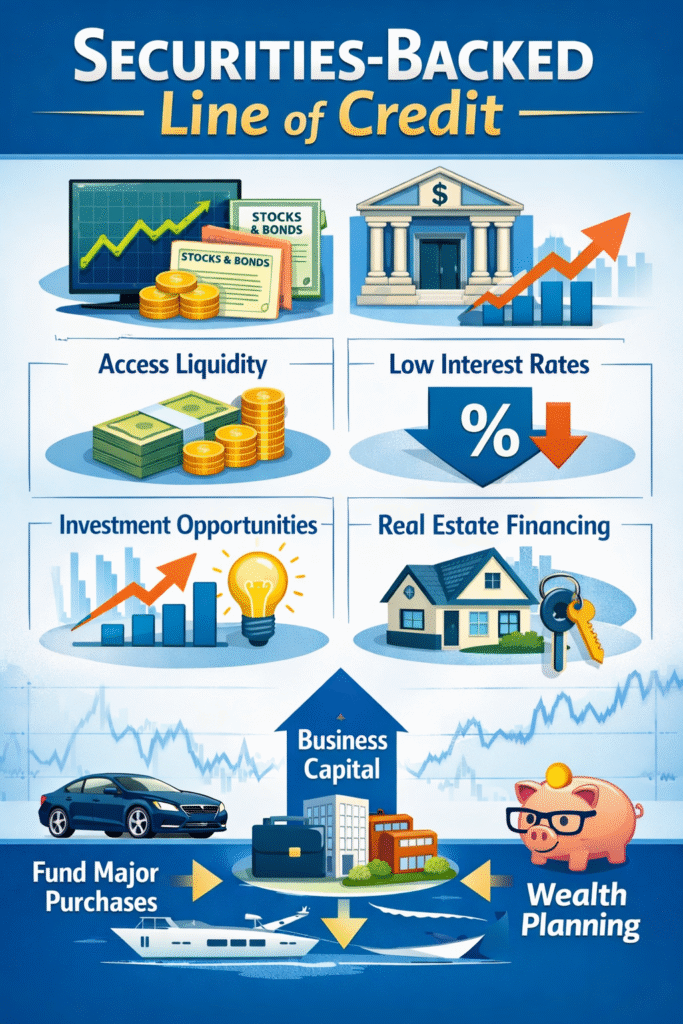

With a Securities-Backed Line of Credit (SBLOC), you can keep your investments fully invested while borrowing against your managed accounts—giving you liquidity without disrupting your strategy.

Brought to you by Charles Schwab and Karstens Wealth

What Is a Securities-Backed Line of Credit?

A securities-backed line of credit allows you to pledge eligible investments as collateral in exchange for a revolving credit line. This gives you fast access to cash while keeping your assets in the market and potentially growing.

✔ Business Expansion

✔ Business Investments

✔ Bridge Loans / Short-Term Financing

✔ Real Estate Purchases

✔ Luxury Purchases

✔ Tax Bills or Seasonal Expenses

✔ ACAT Transfers & Portfolio Moves

✔ And much more

LIBOR-based variable options + fixed-rate options available.

Loan documents delivered within 5 business days.

Access liquidity without selling your securities.

Borrow as an individual, business, or trust.

Use multiple portfolios as collateral if needed.

Use financing to pay off existing loans and transfer accounts seamlessly.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Google reCAPTCHA helps protect websites from spam and abuse by verifying user interactions through challenges.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Marketing cookies are used to follow visitors to websites. The intention is to show ads that are relevant and engaging to the individual user.

Facebook Pixel is a web analytics service that tracks and reports website traffic.

Service URL: www.facebook.com (opens in a new window)

You can find more information in our Privacy Policy and Privacy Policy.